I finally did it.

I ended the “should I or shouldn’t I?” tug-of-war with myself.

I decided to give up Medicare Part B.

After living three years in Spain and Portugal, first as expats and then immigrants, we began to question whether we’d do better by cancelling our “Part B” coverage which cost us $144 per month deducted from our Social Security payments and having more disposable income in our pockets. Sure, we knew that there’d be fines, fees, penalties, and interest if we wanted to rejoin Medicare Part B … but we have no intention of returning to the USA. At least not to live there. Here in Portugal, we have comprehensive, state-of-the-art health care provided both by our public coverage under the country’s universal National Health Service (SMS) supplemented by our excellent private insurance that runs us two thousand euros (€2,000) per year for the two of us–one 70, the other 57.

For those living in the USA, Medicare has formed the foundation of health care coverage for Americans age 65 and older. Here’s how it works:

A portion of Medicare coverage, Part A, is free for most Americans who worked in the U.S. and paid payroll taxes for many years. Part A is frequently considered “hospital insurance.” If you qualify for Social Security, you will qualify for Part A. You’re covered whether you want it or not, as long as you have more than 10 years (or 40 quarters) of Medicare-covered employment.

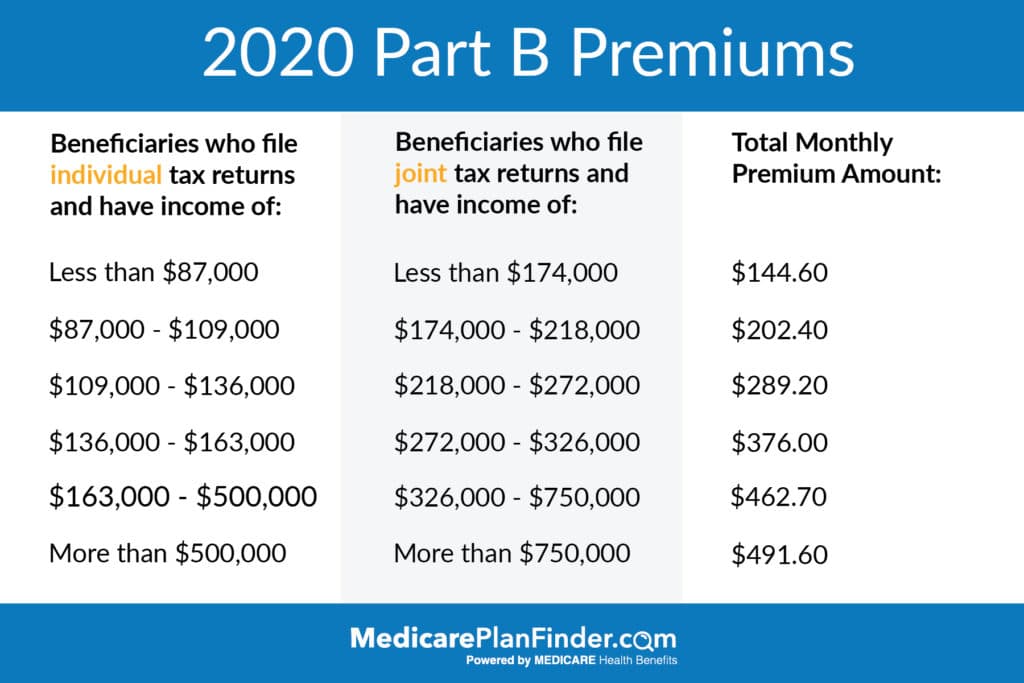

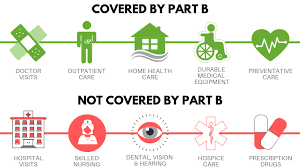

Part B, which many think of as traditional health insurance, isn’t free. You pay a monthly premium for Medicare Part B.

Part A generally covers medically necessary surgery and certain hospital costs; Part B may cover doctor visits while you’re an inpatient. Part B is a voluntary program which requires paying a monthly premium for all months of coverage.

Individuals entitled to Medicare Part A cannot voluntarily terminate their (free) Part A coverage. That’s not permitted by law. Generally, premium-free Part A ends only due to loss of Social Security “entitlement” … or death.

You can, however, voluntarily terminate your Medicare Part B.

Say you’re 65, no longer working, and don’t want to pay premiums for Part B Medicare insurance. That’s OK. But if you opt out, the costs will be higher if you want to get back in.

“In general, when you’re 65 or older, you should decline Part B only if you have group health insurance from an employer for whom you or your spouse is still actively working and that insurance is primary to Medicare (i.e., it pays before Medicare does),” says Social Security.

But what if you are an American immigrant, living outside the USA?

To “disenroll” from Part B, you’re required to fill out a form (CMS-1763) that – under most circumstances – must be completed either during a personal interview at a Social Security office or on the phone with a Social Security representative. For those of us living abroad, we must deal with it through our US embassy.

Social Security insists on an interview to make sure we know the consequences of dropping out of Part B — for example, that we may have to pay a late penalty if we should want to re-enroll in the program in the future.So, why did I decide to disengage myself from Medicare Part B?

Several reasons:

• Neither Medicare Part A nor B covers any health care costs incurred outside the USA. And we live in Portugal and Spain. In other words, we’re paying for nothing–especially because, given the circumstances, we have no plans to go back and live in the USA again.

• The standard monthly premium for Medicare Part B was $144.60 for 2020, up from $135.50 in 2019, which Medicare deducts from my Social Security check. That comes to $1,626 a year—for something I can’t or won’t use. The money will serve me better in my pocket than in the government’s deficit-ridden purse.

• But, most importantly, we found a better and more cost-effective option!

It’s called “travel insurance,” albeit a rather extraordinary plan:Offered by AFPOP through Medal (AFPOP’s insurance brokerage), it covers both me and my spouse for a year anywhere we go — including the USA – for up to 60 days per trip. It’s renewable, regardless of our age; there’s no age limit to enroll, nor higher costs the older you are … neither is there a limit on the number of trips we can take. Moreover, it’s international in scope—including, believe it or not, the USA!

Two plans are offered: Silver and Gold. We chose the Silver, which includes accidental death or permanent invalidity (100,000€), additional indemnity for severe loss (€25,000 for paraplegia, 50,000€ for tetraplegia), and indemnity for dependent children (€5,000 per child). We’ve got five million euros of third-party liability, repatriation, and extensive coverage for health care-related expenses: Medical expenses (10,000€ for sudden illness & 1,000,000€ for accident, which are more than enough here in Portugal) … hospitalization (full coverage, and we’re still covered by Medicare Part A in the USA) … urgent dental treatment … medical expenses in Portugal after returning, when due to an accident or illness occurring abroad … search & rescue … funeral expenses (up to 7,500€– in Portugal or elsewhere).

Also included: loss or theft of luggage (3,000€); luggage delay (750€); loss or theft of essential travel documents (2,000€); trip cancellation (€5,000); trip delay (37.50€ per hour); legal costs (15,000€); detention (5,000€); bail bond (50,000€); kidnap, ransom, and illegal detention (125,000€); political evacuation (10,000€).

Unfortunately, pre-existing “clinical” conditions and health problems aren’t covered. But, as we have none to speak of, that didn’t matter to us since the travel insurance isn only for medical issues we might encounter outside of Portugal (where we’re fully covered).

I don’t mean to come across as an advertising mouthpiece for this particular plan. But, do some homework and research: First, try to find 24/7/365 unlimited travel insurance plans with such comprehensive coverage and so few restrictions … rather than those for a single trip. Next, see if they’ll even sell you a policy if you’re older than 65. Finally, look at the price and what you get for your money.

Complete details about this insurance plan – ideal for people like us, who travel quite often (to Spain) – are available online: http://www.medal.pt/…/produt…/membros-afpop/afpop-viagem

The best part of all is its cost!

We’re paying €351.64 per year for the two of us (the more expensive Gold Plan, with some higher benefit amounts, would cost €552.57).

Converted to US dollars, that equals about $400 or so at today’s currency exchange rates.

Now, compare that to the $1,626 I’d be paying for Medicare Part B this year.

And therein you have the bottom line.

*Complete details about this insurance plan – ideal for people like us, who travel quite often (to Spain) – are available online: http://www.medal.pt/…/produt…/membros-afpop/afpop-viagem

Shared here are personal observations, experiences, and happenstance that actually occurred to us as we moved from the USA to begin a new life in Portugal and Spain. Collected and compiled in EXPAT: Leaving the USA for Good, the book is available in hardcover, paperback, and eBook editions from Amazon and most online booksellers.

Smart decision!

I’d appreciate article about your health insurances in Spain & Portugal.

Thanks for your kind words!

Great post, thank you Pastor Bruce! Very timely for us; I’m turning 65 shortly and and am wading thru Medicare information. My wife and I are assembling D7 materials and hope to be in Portugal by mid year. We’re chafing over spending $ on Part B (and healthcare costs could still bankrupt you if you don’t also buy a substantial “supplemental” plan!). We’ll wait a year or so to confirm Portugal is right for us long term, but learning that such reasonable year round travel insurance exists is great information.

P.S. We’re from Wisconsin and have been inspired by your story of 2 guys from Sturgeon Bay makin’ good in Portugal. Congrats on Portugal Living, we always look forward to it.

Great to meet you, Bob … we look forward to meeting you here in Portugal! Portugal Living Magazine’s new YouTube channel debuts on Tuesday, 1 February, adding yet another dimension to living in Portugal:

https://www.youtube.com/channel/UCUhFP0vVW2AFBG68vfFa6Eg